Why trade CFDs?

CFD trading is a form of derivatives trading – meaning you deal on prices derived from the underlying market, not on the underlying market itself. It’s a popular form of trading because it enables traders to:

Here are the six steps you’ll need to follow to start CFD trading:

1. Make capital go further with leverage 2. Go short or long 3. Trade a huge range of markets 4. Mirror trading the underlying market 5. Hedge a share portfolio 6. Use DMAIf you’re new to contracts for difference, start with our introduction to CFD trading and how it works.

Leverage

CFDs enable your investment capital to go further, as you only have to deposit a fraction of your trade’s

full value to open a position. The deposit you’ll have to put down is called margin.

How much you’ll need to deposit depends on the size of your position, and the margin factor for your chosen

market.

So, if Commonwealth Bank has a margin factor of 5%, then your margin would be 5% of the total exposure of

your trade, whereby a position worth A$1000 (50 share CFDs x $20 per share CFD = $1000), may only require a

deposit of A$50.

However, it’s important to remember that your total profit or loss is based on the full size of your position, not your deposit.

| CFD trade | Traditional trade | |

| You deposit | A$50 | A$1000 |

| Your CBA position rises to A$1025 | You make A$25, or 50% | You make A$25, or 2.5% |

| Your CBA position falls to A$975 | You lose A$25, or 50% | You lose A$25, or 2.5% |

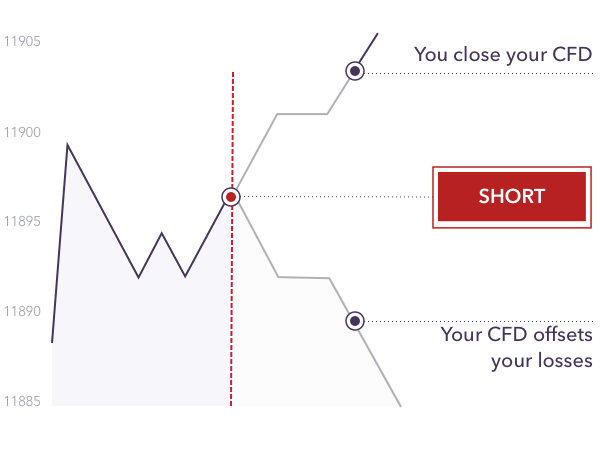

Going short

Because a CFD trade consists of an agreement to exchange the difference between the opening and closing

price of your position, it is more flexible than other forms of trading. This allows you to trade on markets

that are heading down as well as up.

When you trade CFDs on a dealing platform, you’ll see two prices listed: the buy price and the sell price.

You trade at the buy price if you think that the market is going to go up in price, and the sell price if

you think it is going to go down in price.

Trade a huge range of markets

You can use contracts for difference to trade over 17,000 markets, including shares, indices, commodities,

forex, cryptocurrencies, options and more. And you don’t have to access multiple platforms to trade

different markets. Everything is available under one login, wherever you need it – you can trade via your

web browser, your phone or your tablet.

You can even trade some markets outside of trading hours, to make the most of company announcements. Just

keep in mind that the market’s opening price may differ from its out-of-hours price.

Similarity to the underlying market

CFDs are designed to mimic the trading environment of their underlying market fairly closely. Buying an

Apple share CFD, for instance, is the equivalent of buying a single share in Apple – if you want to buy the

equivalent of 2000 Apple shares, you’d buy 2000 Apple share CFDs. However, when trading share CFDs, your

positions will be adjusted to offset the effect of any dividend payments and you won’t receive shareholder

privileges.

Buying or selling a forex CFD, meanwhile, is equivalent to buying a certain amount of base currency by

selling the equivalent amount of quote currency. So buying a single CFD on GBP/USD would give you the same

exposure as buying £100,000 in US dollars.

Hedging your share portfolio

Say, for instance, that you own a number of shares in HSBC, and you plan on holding your shares over the

long term. You believe that the banking sector may be in for a downturn, and you want to offset any

potential losses using CFDs. So you open a short position.

If you are correct and your HSBC shares drop in value, then your CFD position will earn you a profit,

offsetting your loss. If your HSBC shares increase in value, then you can close your CFD position – and

offset the loss you incurred against future profits for CGT purposes.

DMA

If you’re an advanced trader, you can get direct market access (DMA). This enables you to see and interact

with the order books of stock exchanges and forex providers. Instead of trading at the buy and sell prices

offered by famous worldwide trading, you can see all the available bid and offer prices at any given time, and trade

at market prices you choose.

When you choose to trade using DMA, there’s no famous worldwide trading spread to pay – instead, DMA trades are

charged via commission. While it can be a powerful tool, there’s no guarantee that you’ll find prices that

are better than the prices we offer, and it’s only recommended for experienced traders.

FAQ

Most CFD trades are open ended – with some exceptions such as futures and forwards. When you want to close your position you simply place a trade in the opposite direction to the one that opened it.

Yes, you can hold CFD positions overnight. However, you’ll be charged an overnight funding charge. This fee covers the capital you’ve effectively borrowed from us and reflects the cost of holding your position open.

CFD trades are standardised into lots, but each market has its own minimum number of contracts that aim

to mimic how the asset is traded on the live underlying market.

For example, for share CFDs, the contract size is usually the equivalent of one share of the company

you are trading. For forex, there are standard contracts which equal 100,000 units of the base

currency, or mini contracts that equal 10,000 units of the base currency.

For most CFD trades, the cost of making the trade is covered in the spread. This means the buy and sell prices already include any charges. However, our charges for share CFDs are commission-based so that the buy and sell prices match the underlying market price.

Yes, with CFDs you can take a position on a market that is rising in price, and one that is falling. If you decide to buy an asset in the hope that its price will rise, this is known as ‘going long’. If you sell an asset in the hope that its price will fall, this is called ‘going short’.

You might be interested in…

- Managing your risk

- Learn about risk management tools including stops and limits

- Platforms and apps

- Browser-based desktop trading and native apps for all devices