Managing your risk

What are the risks?

| The risk | Why it happens | Ways we help |

|---|---|---|

| Losing more than the money in your account. | CFDs are leveraged meaning you only need to put up a fraction of your trade’s value to open it. So you could lose – or gain – much more than your initial deposit. | You can mitigate risk and lock in profits by setting an automatic stop or limit, to define the level

you'd like your trade closed at. Find out more about stops and limits |

| Having your positions closed unexpectedly, resulting in you losing money. | You need a certain amount of money in your account to keep your trades open. This is called margin, and if your account balance doesn’t cover our margin requirements we may close your positions for you. | Keep an eye on your always-visible running balances in our platform or app, and add more funds if

they’re needed. Find out more about balance snapshots |

| Sudden or larger-than-expected losses (or gains). | Markets can be volatile, moving very quickly and unexpectedly in reaction to announcements, events or trader behaviour. | As well as setting stops, you can also be notified of significant movement by setting a price or

distance alert, giving you the choice of whether or not to react. Find out more about alerts |

| Having an order (an instruction you give us, to open or close a trade for you when the market hits a certain level) filled at a different level to the one you requested. | When a market moves a long way in an instant – or ‘gaps’ – any orders you have placed may be filled at a worse level than the one you requested. This is called slippage. | Use guaranteed stops for watertight protection against slippage. They're free to place, with a small

premium payable only if your stop is triggered. Find out more guaranteed stops |

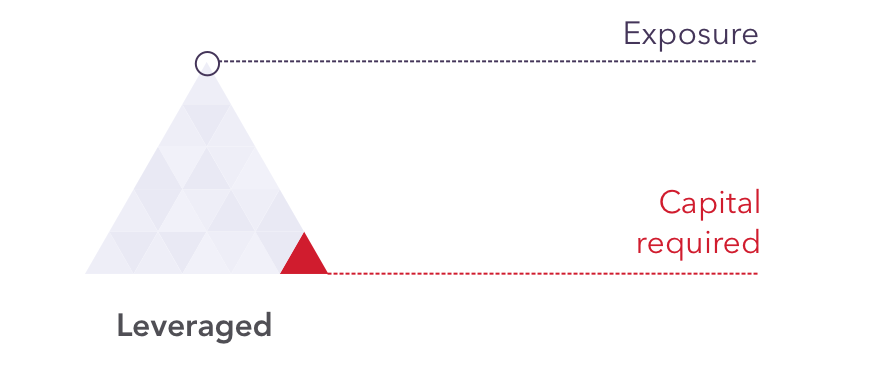

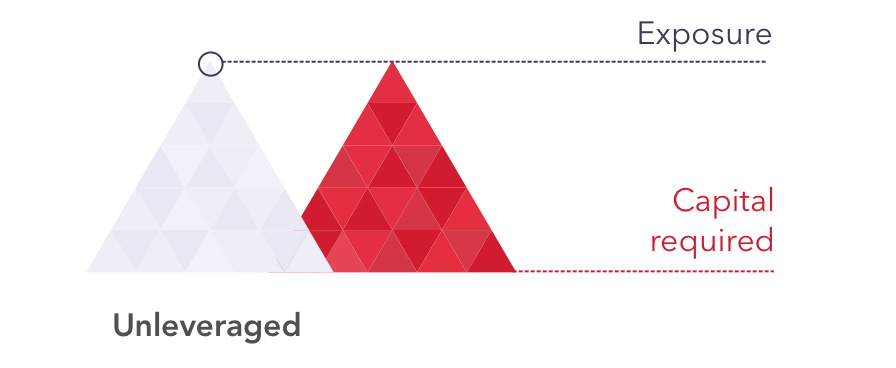

What is leverage?

Leverage enables you to gain a large exposure to a financial market while only tying up a relatively small amount of your capital. In this way, leverage magnifies the scope for both gains and losses.

Is leveraged dealing risky?

Even though you only put up a relatively small amount of capital to open a position, your profit or loss is based on the full value of the position. Therefore, the amount you gain or lose could be relatively large compared to your initial outlay.

Protect yourself in our platform

Trade with limited risk

You needn’t risk more than you can afford when trading. Our limited-risk accounts can help protect you, ensuring that all your positions either have a guaranteed stop, or are on inherently limited-risk markets.

We decide your account type based on the information you give us when you open an account. You’ll have the option to switch to a limited-risk account once your account’s open.

Please note, the other stop types you see listed on this page are therefore not available on limited-risk accounts.